Note from the Author : This post is based on a paper that was presented at the International Research Conference on Management and Finance 2011. I had the privilege of co-authoring this paper with Prof. Gamini de Alwis and Dr. R. Senathirajah from the Faculty of Management and Finance, University of Colombo. The references in this post may seem dated as the research was conducted nearly two years ago. However, the underlying observations and the derived conclusions are still relevant today.

This article is a continuation from the Part I.

As we showed in Part 1 of this article, the general tendency among Sri Lankan software professionals is to shy away from entrepreneurship. We presented our research findings on how wealth or industry expertise alone, would not influence this mindset. We also discussed how they prefer not risk failure by experimenting in entrepreneurship, and stick to their jobs where they feel comfortable.

A brief note about our data analysis…

In our last post, we explained why wealth, is theoretically considered a positive influence towards entrepreneurship. On the other hand, considering the earning potential, we expected to see a professionals be more reluctant to leave their jobs as they accumulate more and more industry expertise. However, we did not observe either in our research.

Since this was a dead-end, we moved on to scanning our data for interesting patterns. Before, we go in to the details, let’s establish the definitions.

- Wealth is the total value of the person’s property, savings, etc.

- Industry Expertise (or the Professional Human Capital) is a measure of the professional’s skills and competencies. The measure includes academic qualifications and the years of experience.

- Entrepreneurial Intent (EI) is a measure of the desire the professional has in setting up his/her own business within the foreseeable future.

“Twenty years from now you will be more disappointed by the things that you didn’t do than by the ones you did do. So throw off the bowlines. Sail away from the safe harbor. Catch the trade winds in your sails. Explore. Dream. Discover.”-Mark Twain

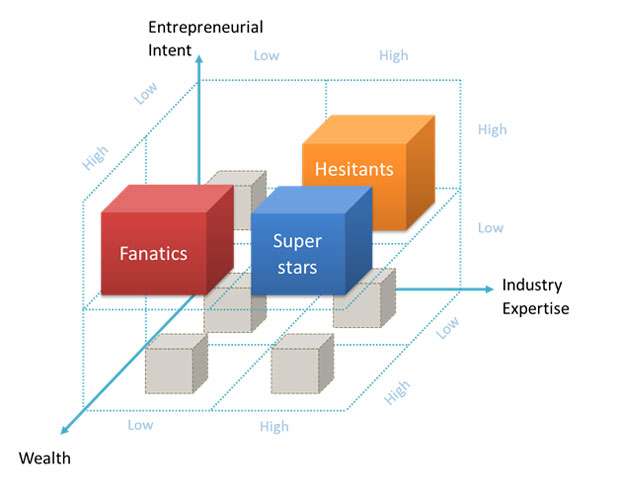

Depending on whether a person scored high or low on each of the 3 variables, we grouped the sample in to 8 segments. We’ll ignore the segments that scored low on EI and concentrate on those who have at least a slight interest towards entrepreneurship.

We also had to leave out the Low Wealth / Low Expertise group as the size of that segment was too small for analysis. So, we ended up looking at the following segments in depth:

- Superstars : High wealth, high expertise

- Hesitants: Low wealth, high expertise

- Fanatics: High wealth, low expertise

Fanatics group was made up of fresh graduates who came from wealthy backgrounds. We felt that their willingness to get in to business was too premature. We believe that they should remain as professionals until they have the expertise to launch a high tech business with a high growth potential. Premature entrepreneurs are very likely to create unsuccessful ventures. And when those fail, they leave behind a popular belief that Sri Lanka is a hostile environment for tech startups.

Professionals that fell in to the Hesitant category, had both the industry expertise as well as the financial motivation to start a business. Some even felt that there was only a slim potential for further career growth. Most of them had done some freelance work on the side but, had not taken any concrete steps towards full-time entrepreneurship. From the common patterns emerging from their responses, we believed that these individuals had the most desire to become entrepreneurs. The fear of failure and the lack of financial strength may have been holding them back.

The Superstars, on the other hand, consisted of experienced and top ranking professionals; majority being over 30 years of age. With the high level of industry expertise and the higher tolerance for financial risk, this group had the highest potential to set up high-tech, high growth businesses. Majority of the group, however would consider setting up a business in the next 5 to 10 years. This again, demonstrates that despite being indifferent to the financial risk, they were unwilling face the risk of failure. They would consider entrepreneurship as a retirement plan, not a career choice.

So, what would it take to break this barrier? We’ve established that the possible financial/social consequences of failing are the reasons holding you back from starting a business. So, would you start a business if we give you:

- The ability to share your risk?

- Peer recognition and validation at the onset of the business?

The result was a near 30% increase across all segments on the likelihood of starting a business. Surprisingly, this increase was even higher (33%) among the low-EI/high-wealth/high-expertise group. We had initially labeled them as the “Carefree” as they seemed to be looking forward to retirement without any interest in complicating their lives with entrepreneurship activity.

The twist in this is that, we didn’t really ask the above question. What we did ask was, whether they’ll set up a business if they can have a co-founder for their startup. Let’s see how this question translates in to the above.

A partnership is an opportunity to share the financial risk of the business. You are no longer the only person liable for the losses. Maybe, your co-founder can bring the capital while you contribute the expertise to the business. Not only that, it may even be possible for the partners to tag-team in running the business so that initially, both can minimize the career risk by staying employed at lease on a part-time basis.

Either way, the “peer recognition” aspect is the most interesting part of the question.

By agreeing to come onboard, a fellow professional is taking an equally risky career choice. In order to accept he/she must evaluate and recognize the validity of your business case. This validation and the sense of social acceptance, is a great motivator for the entrepreneur and adds momentum to the startup effort.

“Your time is limited, so don’t waste it living someone else’s life. Don’t be trapped by dogma – which is living with the results of other people’s thinking. Don’t let the noise of other’s opinions drown out your own inner voice. And most important, have the courage to follow your heart and intuition. They somehow already know what you truly want to become. Everything else is secondary.”- Steve Jobs

How do we translate this in to action?

So, sparking entrepreneurship among software professionals isn’t really an expensive problem. It’s not a problem of building infrastructure, setting up seed funds or affecting policy reform. It’s a matter of bringing likeminded people together and nurturing collaboration towards setting up businesses. The obvious challenge is creating an environment of trust, in which they feel confident about sharing ideas and strategies. Existing startup incubators can take the lead on such an initiative as they have the means to support the partnership from the immediate next steps in the process.

Alternatively, a great initiative would be to rally up high wealth / high expertise segments in to Angel Networks. As Angel Investors, these professionals will have the opportunity to gain the benefits of business-ownership, while being able to distribute the risk of failing across several companies and co-owners. Such Angels will motivate Hesitants to take up more responsibility in the operational side of running the business; all of which would speed up the cycle of new businesses getting off the ground.

Crippling emotions

As we’ve found out in this research, we have only ourselves to blame for the lack of entrepreneurship among our software professionals. Yes, ourselves; not the lack of infrastructure, lack of funding, or messy political landscape. The problem and the solution aren’t financial; they are emotional. It’s unreasonable for us to demand that people change and get over their fear of failure and the fear of being criticized for failure. Therefore, we’ve conceptualized a strategy to build emotional support to take this first step, by identifying the critical role a co-founder could play. We hope that what’s presented here, lead to a healthy discussion on enhancing collaboration among workforce segments and eventually lead to a vibrant startup culture.

References and Recommended Reading

[1] Iyigun, M.F. & Owen, A.L., 1999. Entrepreneurs, Professionals, and Growth. Journal of Economic Growth, 4, pp.213-32.

[2] Hurst, E. & Lusardi, A., 2004. Liquidity Constraints, Household Wealth, and Entrepreneurship. Journal of Political Economy, 112(2), pp.319-47.

Image credits: